Why Account Aggregation is Priority for Banks in the PSD2 Era

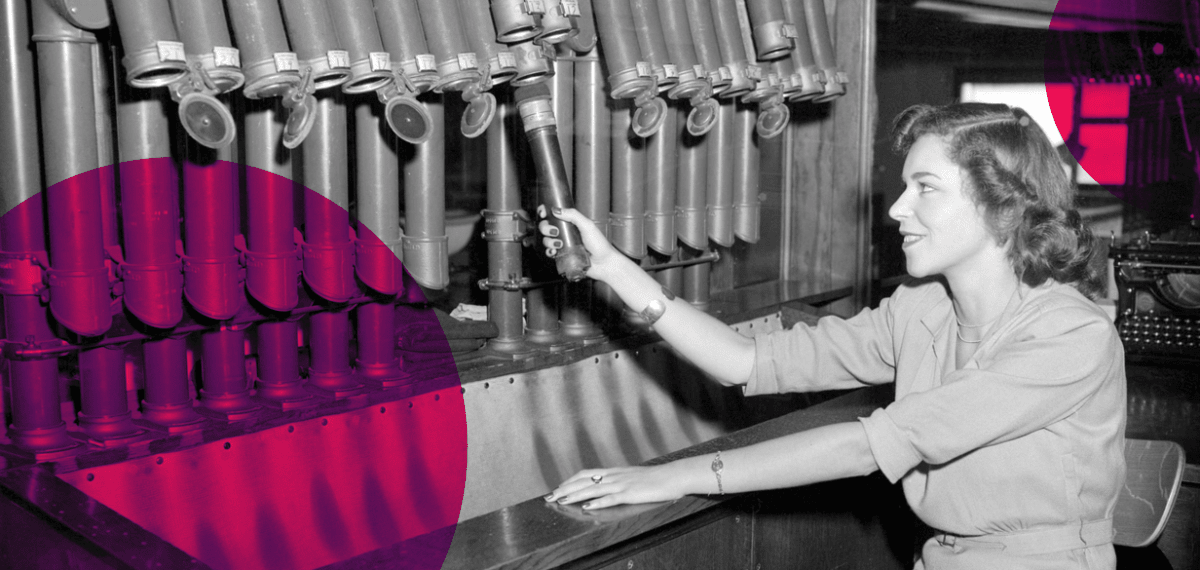

From the era of the Pneumatic Tubes we were trying to aggregate information. But after this evolution, none can answer with certainty the simple question, “How much money do I have in my bank accounts?” And this uncertainty gets bigger when the money is spread in more banks and more accounts. And even bigger when multiple currencies are involved. And impossible when transactions modify the accounts continuously.

This is what accounts aggregation seeks to cure. While fintechs are already on it, banks have little choice than to make it a priority.

Opportunities for Banks in Account Aggregation

Add-on Services

Once data from different accounts is aggregated under one roof through APIs, banks should be able to extract knowledge and build services on top of it that will create value to customers and build a competitive advantage against competitors. These services could include:

•Comprehensive liquidity management for businesses and individuals, which will improve the quality as well as the timing of expenditure and investment decisions.

•Predictive capabilities, developed by coupling large amounts of data with artificial intelligence to generate customer insights.

•Cash flow management for SMEs done by harmonising payments, invoice data, insurance premiums, loans data etc. to provide a 360-degree view of a business’ finance at the click of a button.

Protection Against Brand Erosion

Putting into consideration that thousands of fintechs are already working on account aggregation products, customers will have little need to log into individual banks when they can access all of them via a single interface. Thus, for every new customer fintechs acquire, banks will lose a share of their customer interaction time. In the long-term, this can dilute a bank’s brand and erode customer loyalty.

To counter this, banks that focus on aggregation and help clients collect account data via their platforms instead of third-parties, will keep customers in their pipeline and be able to capitalise on their already strong brand positioning.

Competition with Neobanks and Fintechs

Should incumbents fail to prioritise account aggregation now, competing against digital-native Neo-banks and fintechs will be a tougher battle in the future. These challenger banks already collectively threaten the business models of traditional banks.

For instance, a 2018 study by Finnovate Research, pegged the customer acquisition cost of neobanks between $1-$28 and that of traditional retail banks at $200. In the UK, neobanks paid slightly more than twice the savings interest rate offered by their traditional counterparts.

All in all, when a competitor possesses such competitive advantages, account aggregation should not be an area that incumbent banks lose out when they can come out ahead in this PSD2 race.