Payments HubGenAI

Migrate to ISO20022 and Instant Payments using the first Generative AI enabled payment HUB

Request a demoSome of our valued customers

Υou need an AI-Driven Payment Hub to handle Financial Messages effectively

- To simplify the handling of different schemes & protocols, such as Cross Border (CBPR+) and Domestic Payments

- To offload the burden of implementing new payment Instruments such as Instant/Real-time Payments, Credit Transfers, Direct Debits, RTGS, HVPS

- To streamline the SWIFT ISO 20022 migration process and future-proof your business against continuous market changes

- To decouple your payments from your inflexible core system and improve time to market

- To have a know-it-all Generative AI assistant with insights on your payment data to support you with AML compliance

Available payment schemes and instruments

aplonHUB supports out-of-the-box cross-border, regional, and local schemes and instruments. New ones can also be added easily on demand.

Payment schemes

- SWIFT MT

- ISO20022

- SEPA (several ACH flavors)

- TARGET2

- CBPR+

- MEPS+

- FedNow

- SIC / euroSIC

- Request for a new scheme

Instruments

- Credit Transfers

- Direct Debits

- Instant Payments

- Request-to-Pay

- RTGS (Real-Time Gross Settlement)

- HVPS (High Value Payments System)

aplonHUB at a glance

Connectivity

Easy core banking integration

Payment rails connection

Flexible Scheduling

AI Innovation

Identify potential fraudulent activities

Increased Efficiency

Reports & Statements

Simplicity

Unified management

Embedded message translation

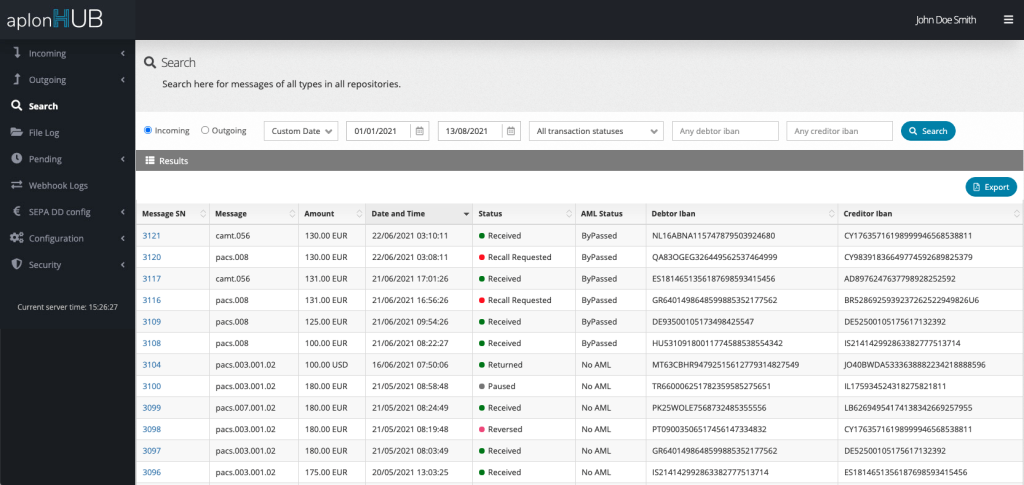

Advanced search

Security

User Management

Advanced Security

AML integration

See what aplonHUB can do for you

Key Benefits of aplonHUB

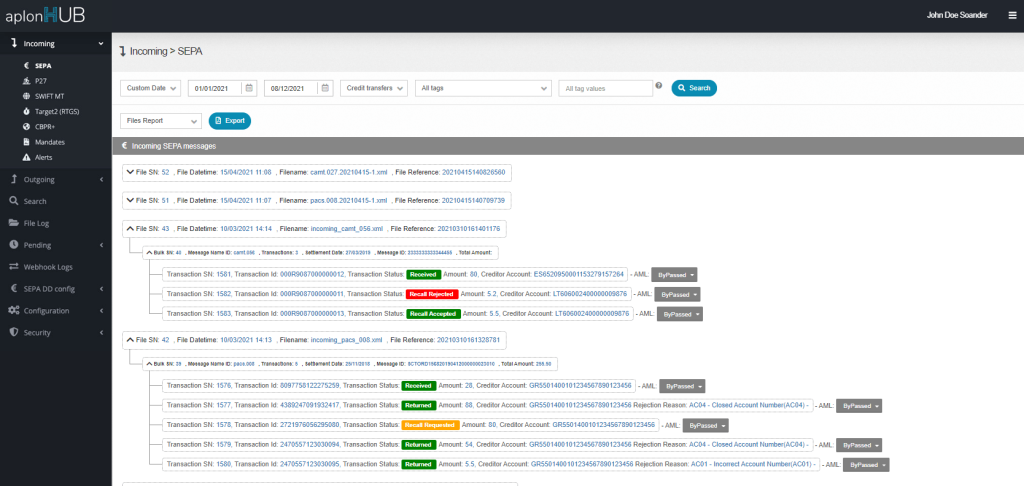

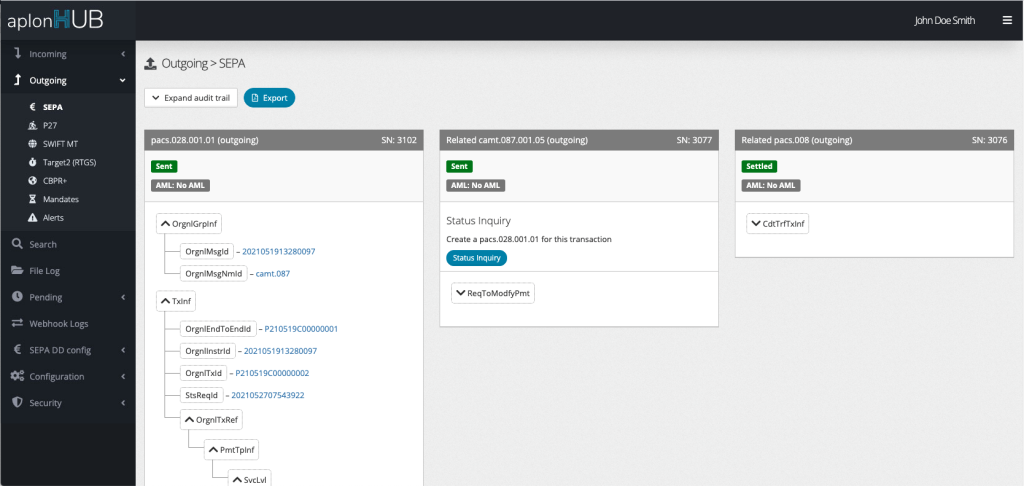

Single view for all types of payments with one application. Supports SEPA Credit Transfers, SEPA Direct Debits and Instant Payments, SWIFT MT, ISO20022 cross border payments (CBPR+), TARGET2 and Real-time Payments.

Rapid time to market, fast SWIFT ISO 20022 migration and reduced total cost of ownership. Fast and easy to install on your premises and even faster to connect in the cloud. Go live in just 2 weeks to 2 months!

Unparalleled efficiency and flexibility among Payment Hubs. API native, it seamlessly integrates with your core and AML systems in a number of other ways if required.

Ideal for any size banks, Payment Service Providers or Fintechs. Start simple, extent and scale up to handle all the complex flows as your business grows in the Fintech era.

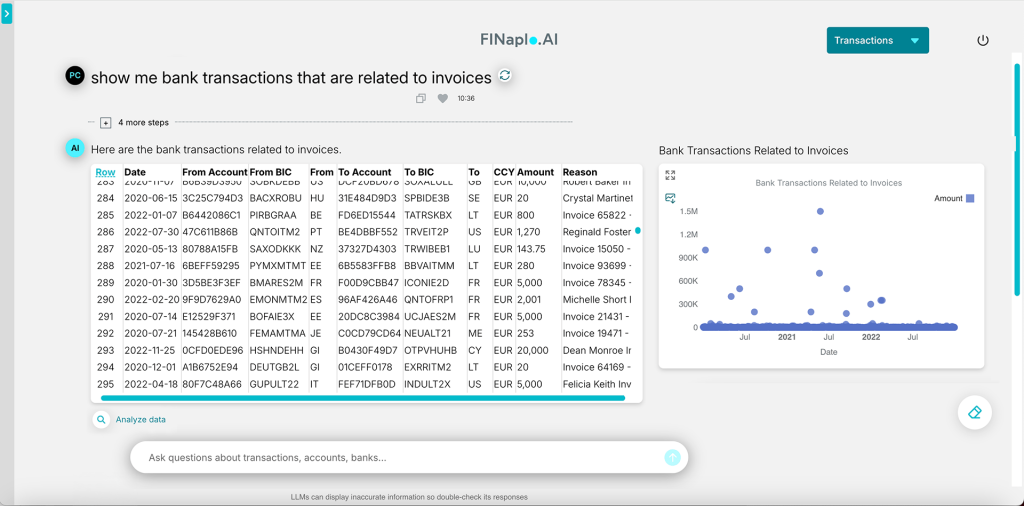

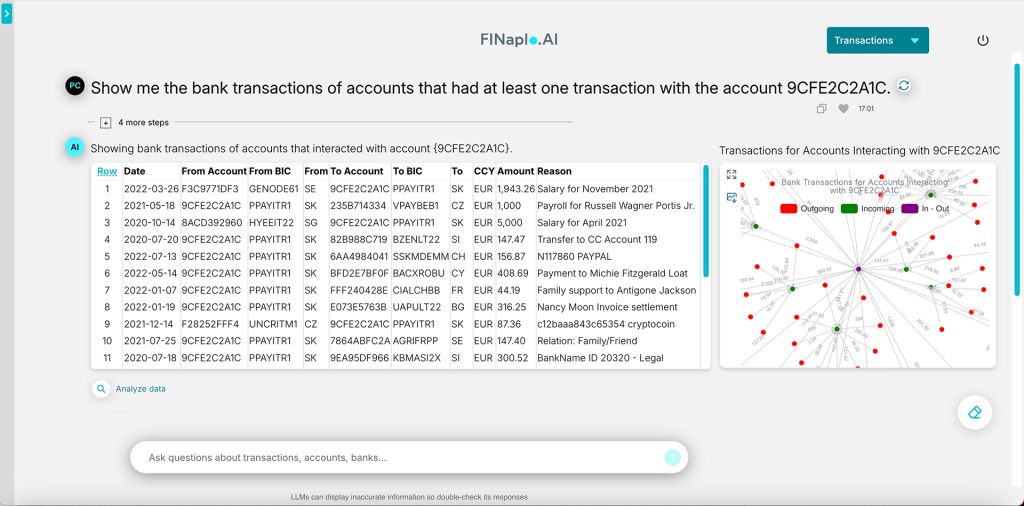

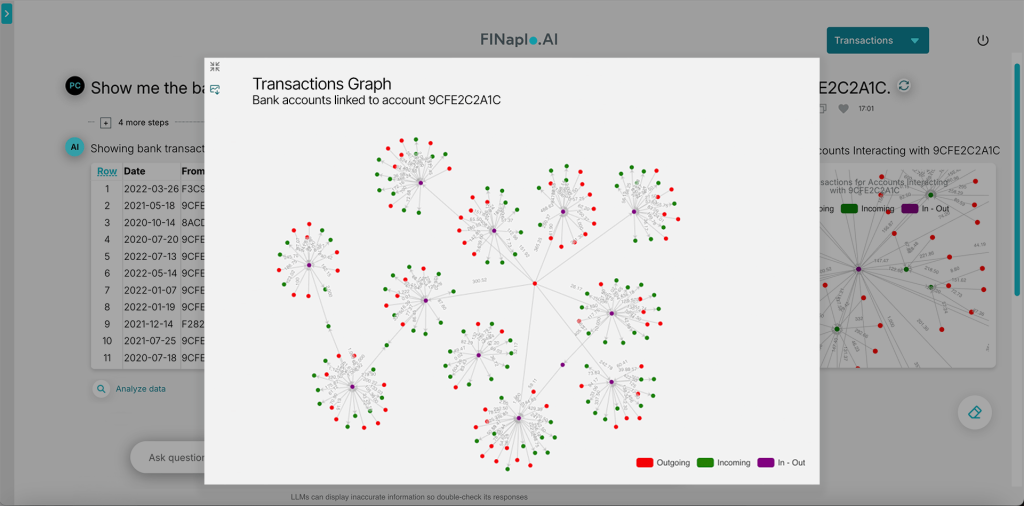

Equipped with an AI assistant, to help you find useful insights and investigate your transactional data in a way that was not possible before. Just by chatting with natural language with FINaplo.AI

Reporting on your transactional data, with tables, charts, and graphs so easy to get and download. Just ask for them from FINaplo.AI, your conversational AI and you’ll have them immediately

aplonHUB + Generative AI

Navigate the world of account-to-account payments safely with a generative AI assistant, now integrated within aplonHUB. The first Payment Hub to incorporate a conversational AI.

AML Investigation

- Explore a new dimension of AML investigation with conversational AI

- Engage in intuitive dialogues to unravel complex financial scenarios and ensure compliance

Money Talks

- Get useful insights from your ISO20022 data, that were hidden until today

- Delve into rich replies featuring text, tables, charts, and graphs, all readily downloadable for your convenience

Solid Security

- No sensitive data are exposed outside the bank environment

- Remain compliant effortlessly with industry standards and regulations

Seamless Integration

- Access FINaplo.AI directly from the aplonHUB dashboard

- A consolidated platform addressing all your payment and investigating queries

Pricing

- Simple, straightforward pricing structure

- Annual flat fee per payment scheme

- Unlimited users / messages exchanged/API calls

- One license for all required environments DEV/SIT/QA/LIVE

Technical Info

- Lightweight Payment Hub and compatible with all leading RDBMSs

- Modern 3-tier architecture and easily scalable

- Extensive configuration from the web user interface (UI)

- API-first architecture, all web UI functionalities also available via APIs

For more technical information check here

FAQs

What is aplonHUB

What is aplonHUB?

How does aplonHUB integrate with existing banking or legacy systems

How does aplonHUB integrate with existing banking or legacy systems?

What financial message standards does aplonHUB support

What financial message standards does aplonHUB support?

Can aplonHUB handle both incoming and outgoing payments

Can aplonHUB handle both incoming and outgoing payments?

What are the key features of aplonHUB

What are the key features of aplonHUB?

What makes aplonHUB unique compared to other payment hubs

What makes aplonHUB unique compared to other payment hubs?

How does the implementation process of aplonHUB work

How does the implementation process of aplonHUB work?

What kind of support and maintenance do Payment Components offer for aplonHUB

What kind of support and maintenance do Payment Components offer for aplonHUB?

Can aplonHUB be customized to fit specific organizational needs

Can aplonHUB be customized to fit specific organizational needs?

How secure aplonHUB is

How secure aplonHUB is?

The application has its own built-in security mechanism or can integrate with Windows Active Directory.