PSD2 = Multiple Customer Journeys

PSD2 is rapidly becoming a "household name", across the Banking industry in the EU, fueled by the ticking clock of looming compliance & regulation, as well as the promise of Open Banking opportunities...

At PaymentComponents, we've been experiencing this transition first hand, on a day to day basis, over the last 3 years, as we engage with all stakeholders (banks, regulators, fintechs, corporates) through our diverse portfolio of tools & solutions. We've also been "blessed", with the ability to have a clear view of things to come, through several pioneering Open Banking projects which are already live & kicking!

On the PSD2 front we're seeing a gradual clarification of technical details, with the release of the final RTS on SCA and CSC. Possibly the only major piece - still missing - is how the TPP registry, will be implemented by EBA and the national Competent Authorities.

However, the key Business "mechanics" & day to day operational nuances, are still elusive to most stakeholders.This article is the first in a series, focusing on shedding some light on practical PSD2 (and overall Open Banking) considerations.

I'll initially be focusing on the expanded definition of what a Customer is, in a post PSD2 / Open Banking environment. To do so let me begin, by juxtaposing a "before and after" view of the Banking environment. First let's start with the traditional model in a world "before PSD2 / Open Banking".

This is effectively a "Silo" business model, with the Bank having complete ownership of all available touchpoints (e.g web banking, mobile app etc), for it's single type of customer - the account owner (retail or corporate). Things change dramatically when you consider a "post PSD2 / Open Banking" world.

The key difference here, is the introduction of TPPs (Third Party Payment Service Providers), which are effectively creating their own applications (e.g. PFM, BFM, eWallet etc), to be used by the account owners and consume the APIs exposed by the bank. This has two immediate & substantial effects:

1. A new type of customer is introduced for the Bank. The TPPs - effectively the developers behind these applications - are equally and potentially in some cases even more important, as the account owners. Banks need to understand, that in order to be successful in engaging with them, they must acknowledge their existence & cater to their needs.

2. The Silo model - although still present & valid - is now augmented by a Marketplace / Shared Economy ecosystem. Banks must quickly accept this fact & seek potential guidelines / lessons learned, from other industries, which have already experienced this transition (e.g. airlines & hotels)

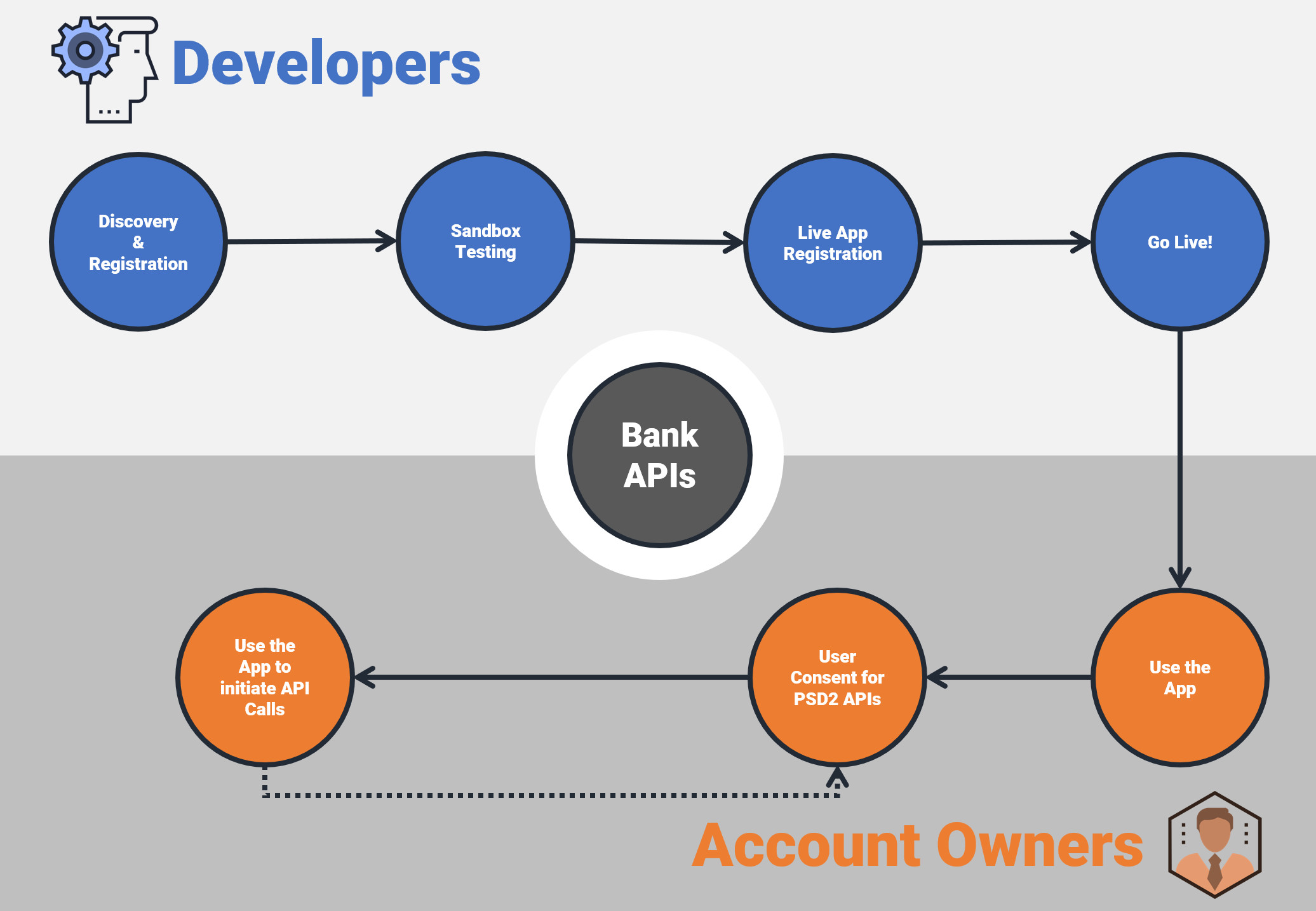

Reverting back to the title of the article, it's important to point out, that the multiple Customer Journeys (Developers & Account Owners), established by PSD2 / Open Banking, are now interwoven. To gain a better understanding of how this unfolds, take a look at the following flowchart:

On this basis, we developed an award-winning product, called aplonAPI, which represents the best solution available today for financial institutions that are willing to stay on top of the competition. With aplonAPI you will be able to offer Banking as a Service/Platform (BaaS/BaaP) solutions to your customers and monetize your APIs in the simplest and fastest way possible. The best part is that you get a ready-to-use API sandbox, with a FinTech ecosystem of AISPs and PISPs, to modernize your payment system quickly and that can help you generate value from day one.

If you are interested in learning more about aplonAPI, all you need to do is schedule a demo today and we will get back to you as soon as possible to show you all the possibilities and how easy it is for you to get started with it.