Open BankingAPI Management

Built exclusively for Financial institutions of the Open Banking era

Onboard with us

Open banking and PSD2 are the biggest change in the financial industry in decades.

In fact, they are more impactful than web-banking and mobile banking combined.

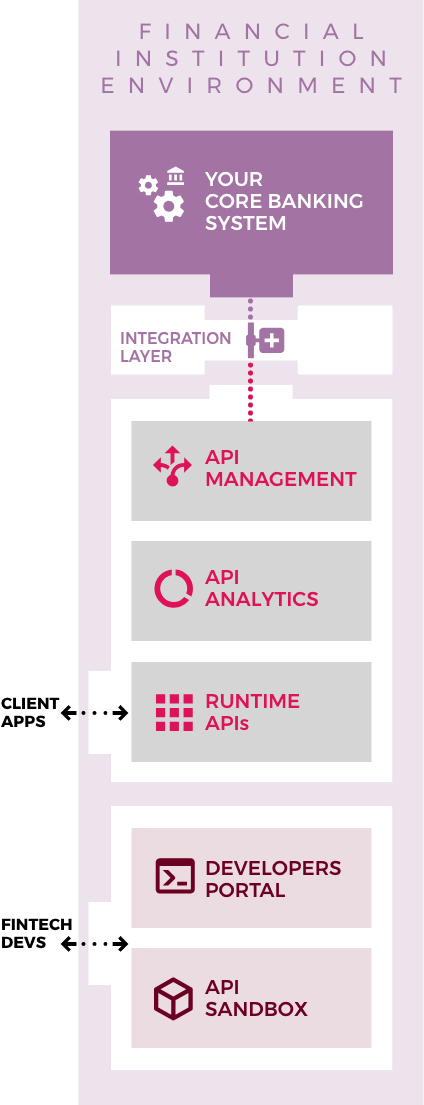

For this reason, we built the aplonAPITM solution with Financial Institutions of the future in mind. Forward-thinking institutions can now offer Banking as a Service (BaaS) or (BaaP) solutions to their corporate or retail clients. Through an API connected FinTech ecosystem of AISPs and PISPs, you will open your newest and biggest revenue channel, and you will actively participate in the movement towards multibanking.

OPEN BANKING API MANAGEMENT

BY PAYMENTCOMPONENTS

What makes aplonAPI better fit

for open banking & PSD2

Adds true Value to the bank

aplonAPI acts as a value generator for business and technology from day one. The Billing and SLA modules let you monetize your APIs. You start seeing revenue from a channel much broader than your web or mobile apps. Start creating beneficial partnerships with AISPs and PISPs and create your own ecosystem. Go beyond Open Banking Regulation and use the platform to manage private APIs to harmonize internal development. This way you expedite and normalize your own development projects. You can also expose B2B APIs to attract and facilitate communication with large corporates.

Ready-to-use sandbox

Immediately initiate your online presence with an out-of-the-box sandbox. It comes with prebuilt and tested PSD2 APIs in any of the major open banking standards. Without any effort on your part, you get a sandbox for - Authentication / Account Owner Consent, - Payment Initiation API, - Funds Availability API, - Account Information API, - Second Factor Authentication (using the OAUTH 2.0 protocol). Any AISP and PISP can test their applications immediately as sample users, accounts, and Strong Customer Authentication (SCA) features are included.

Branded developers portal

It comes prebuilt and ready to launch with out-of-the-box developers onboarding, application registration, logging, billing, and marketplace features for AISP, PISP, and client applications. With the provided source code you can customize it and brand it. You can even extend it for any future regulated or not API, or functionality you want to provide to your fintech ecosystem. With this unparalleled flexibility, you can even modify the UI or use the underlined APIs to integrate it into your website.

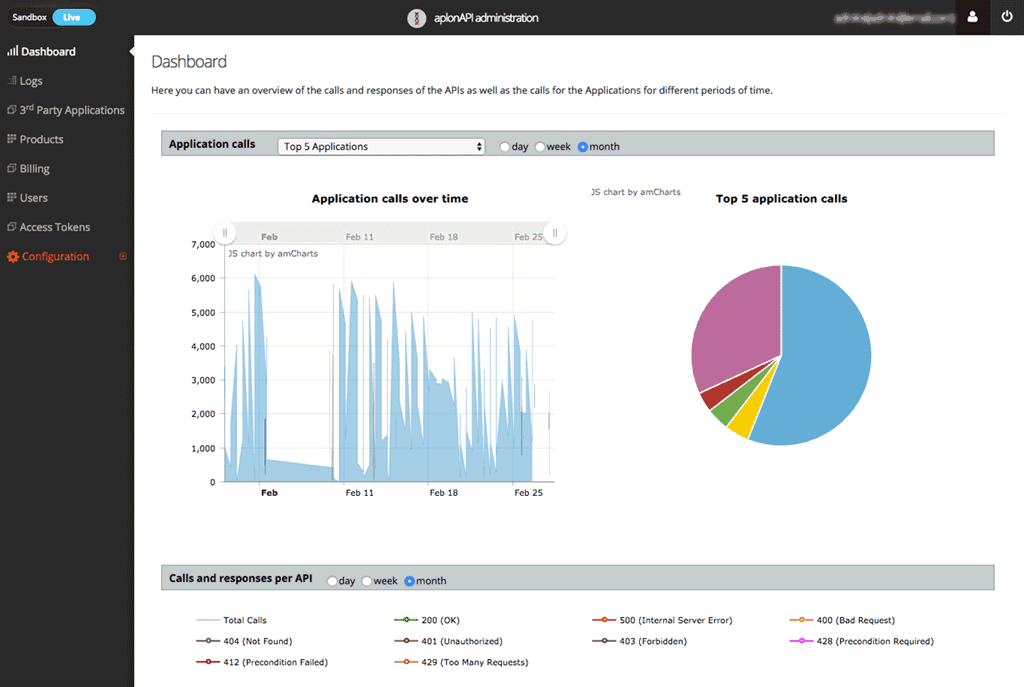

Open Bank features

Supports out-of-the-box Berlin Group, Open Banking UK, or any other Open Banking standards. It fully supports the PSD2 directives on Strong Customer Authentication (SCA), Consent management, and TPP verification through QSEAL and QWAC validation. Helps you define multi-tier billing layers & combine them with actual usage logs to generate all the necessary billing information. It also monitors the performance of Payment Initiation, Account Details, Funds Availability, and any other exposed APIs. PaymentComponents even provides you with client applications in Sandbox to test the data of your financial transactions and start populating your marketplace.

The aplonAPI pedigree

Generic API management tools are not the best solution for financial institutions. aplonAPI platform was created by financial technology experts and is optimized and customized for Financial Institutions specifically for Open Banking. Working with Paymentcomponents, you partner with a Fintech specialized in Open Banking and Payments and therefore leverage the first-mover advantage of our continuous innovation.You become part of the global thought leadership on open banking and get the opportunity to be awarded as "leading digital initiative" and "Usability / User Experience Excellence" as some of our customers.

Cutting edge technology

aplonAPI is built from the ground up, as a truly open API platform. All internal functionality is exposed as APIs, to access them from your web banking or mobile banking. It fully leverages cutting-edge technology trends such as microservices, dockers, Kubernetes for unparalleled elasticity and scalability. For blazing speed, it utilizes in-memory databases, ELK stack (Elasticsearch, Logstash, and Kibana) asynchronous traces, and can be installed in the cloud or on-premise.

How the magic works

Do you want to see it working?

Let’s schedule a 15 minute demo

OK, I am in! The best way to answer all your questions