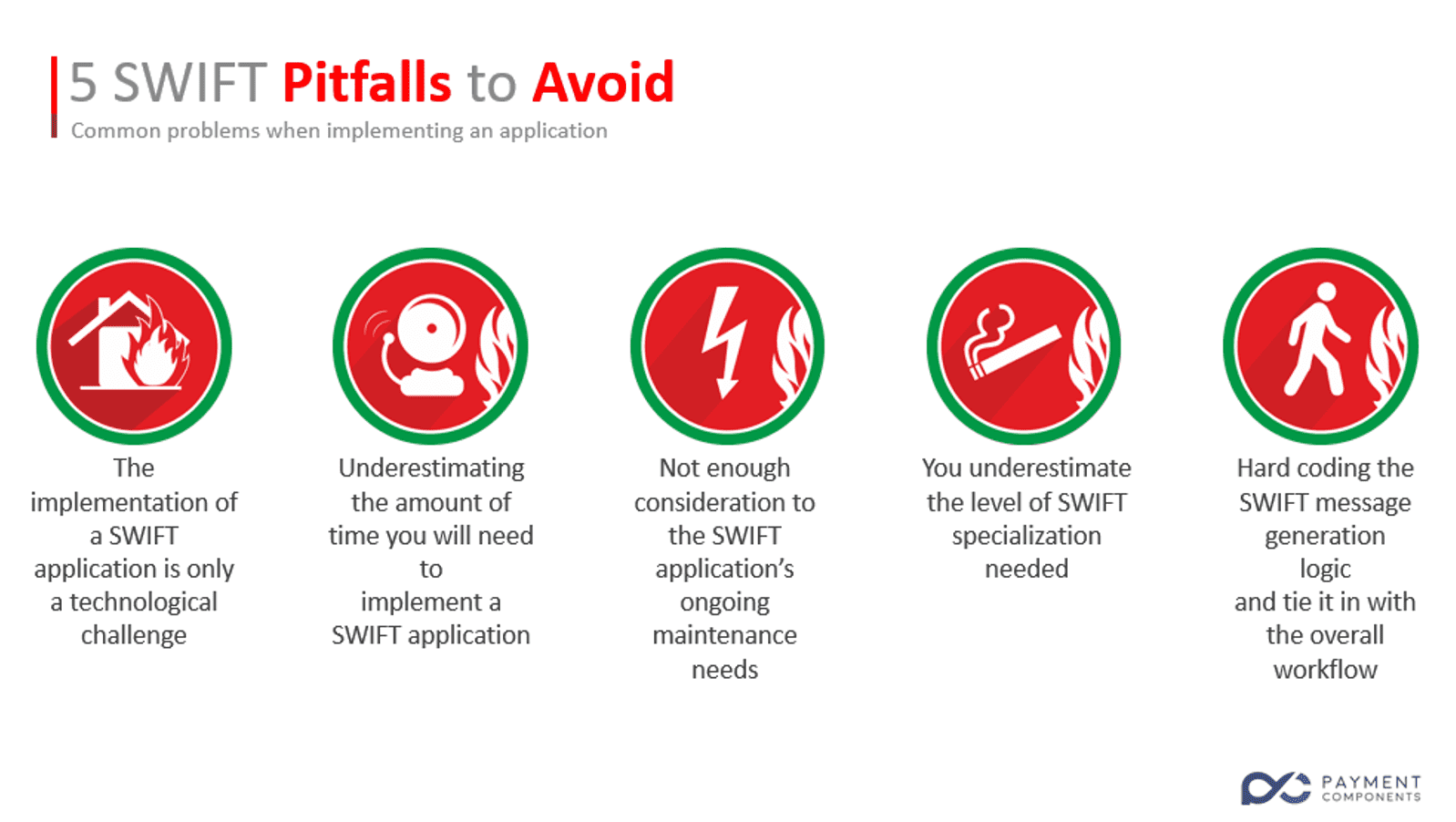

How to avoid the 5 most common pitfalls when implementing a swift application

Payment Components have been a leading provider of SWIFT financial

messaging solutions to financial institutions, banks and software

companies for over eight years. And we have served many clients who

have come to us after first experiencing problems with their initial attempts

at implementing a SWIFT related application.

So in the interests of any financial institution, bank or software company

who is considering implementing a SWIFT application and

are perhaps

wondering if there are potential issues to avoid we

have set out the 5

most common problems when implementing a SWIFT application in this

article.

The 5 Most Common Problems When Implementing a

SWIFT Application

1. Seeing the implementation of your SWIFT application is

a technology only challenge

When implementing a SWIFT application one needs to take account of the

wider strategic business needs and have a thorough understanding of all

the flows of the SWIFT message exchanges. Choosing a strategic SWIFT

business partner, rather than just hiring a talented programmer who

can

build a good parser and validator for the SWIFT messages will

ensure you

achieve this.

2. Underestimating the amount of time you will need to

implement a SWIFT application

This typically occurs as a result of the first problem detailed above,

because SWIFT developers working alone are unlikely to understand the

full implications of the business deliverables and underestimate the amount

of rulebook research required.

3. You do not give enough consideration to the SWIFT

application’s ongoing maintenance needs

SWIFT messages change continuously, so it is essential that your team

keeps uptodate

with every change by subscribing to the relevant authority

and ensuring that they implement the necessary changes long before they

become operative.

4. You underestimate the level of SWIFT specialization

needed

Your SWIFT developer and analyst team will need continuous professional

development to ensure your SWIFT application is maintained correctly for

its lifecycle. And you will need to reinvest in the same level of training and

professional development for any new or replacement team members.

5. You hard code the SWIFT message generation

logic and tie it in with the overall workflow

You will either need the flexibility to alter the workflow or appetite to

enhance functionality with new or updated (as part of the annual SWIFT),

messages in the future. And you will need a proper decoupling approach

such as the one third party libraries provide.

Conclusion

If you represent a financial institution, bank or software company and are

considering the implementation of a SWIFT application, I hope this article

will help you avoid the common problems that some of our clients

experienced prior to partnering with Payment Components and ensure your

SWIFT application is implemented correctly, the first time. And that your

chosen SWIFT team is prepared and capable of looking after your future

SWIFT requirements too.

And of course Payment Components would be delighted to help you avoid

all of these problems and provide you with a comprehensive quotation for

your specific SWIFT financial messaging project, which would include

ongoing maintenance.