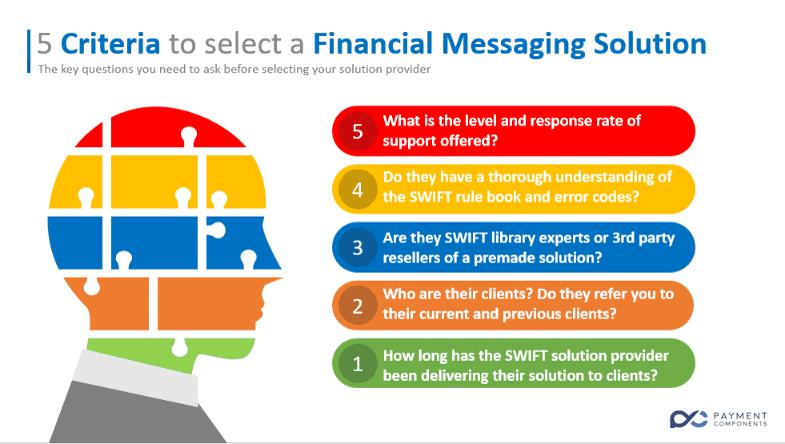

5 Critical Questions You Must Ask When Choosing Your SWIFT Financial Messaging Solution Provider

Payment Components have been providing SWIFT financial messaging

solutions to financial organizations, banks and software companies for over

eight years and has served many clients’ needs worldwide.

And when we receive feedback from our clients and ask them what were

the most critical questions they needed answering when

they were

choosing their SWIFT financial messaging solutions provider they

typically

share the same or very similar questions.

So we thought it would be helpful for other financial organizations, banks

and software companies who are starting to consider SWIFT financial

messaging solution providers and

perhaps are wondering what some of

the critical questions they needed to ask are if

we set out the most

common critical questions our clients and previous Payment Components’

clients have asked in this article.

The 5 Critical Questions You Must Ask When Choosing

Your SWIFT Financial Messaging Solution Provider

1. How long has the SWIFT solution provider been

delivering their solution to clients?

Because the SWIFT product is integrated deep within a client’s own

software and would represent a major business upheaval to replace,

prospective SWIFT messaging clients should be certain the potential

solution provider has been and will be delivering their service to clients for

the long term.

2. Who are their clients and are they willing to refer you to

their current and previous clients?

Whether you represent a financial organization, bank or software company

it’s not only critical that your chosen SWIFT solution provider has relevant

domain experience within your particular business sector, but that they are

also prepared to refer you to their current and previous clients.

3. Are they SWIFT library experts or 3rd party resellers of

a premade solution?

Not all SWIFT solution providers are equal and some providers are simply

resellers of a third party solution and will not be able to offer the level of

support, maintenance or customization that you may need now, or in the

future.

4. Do they have a thorough understanding of the SWIFT

rule book and error codes?

The SWIFT rule book and error codes are complex and considerable and

only solution providers with specialist domain experience are likely to have

a comprehensive knowledge of both the SWIFT rule book and the error

codes.

5. What is the level and response rate of support offered?

How responsive will your chosen SWIFT financial messaging solution

provider be for your support requirements and who will provide the actual

support? Will the support be provided by the same key team who provided

you with the original proposal and quotation or will you deal with less

experienced support staff once you become a client?

Conclusion

Asking these five critical questions of the SWIFT financial messaging

solutions providers you are considering for your project at the outset will

help ensure you find a partner who can best serve your needs now and in

the future.

And of course Payment Components would be delighted to answer each of

these questions for you and provide you with a comprehensive quotation

for your specific SWIFT financial messaging project.