MultibankingAPI Connector

An SDK to connect your application with multiple banks through APIs

Onboard with us

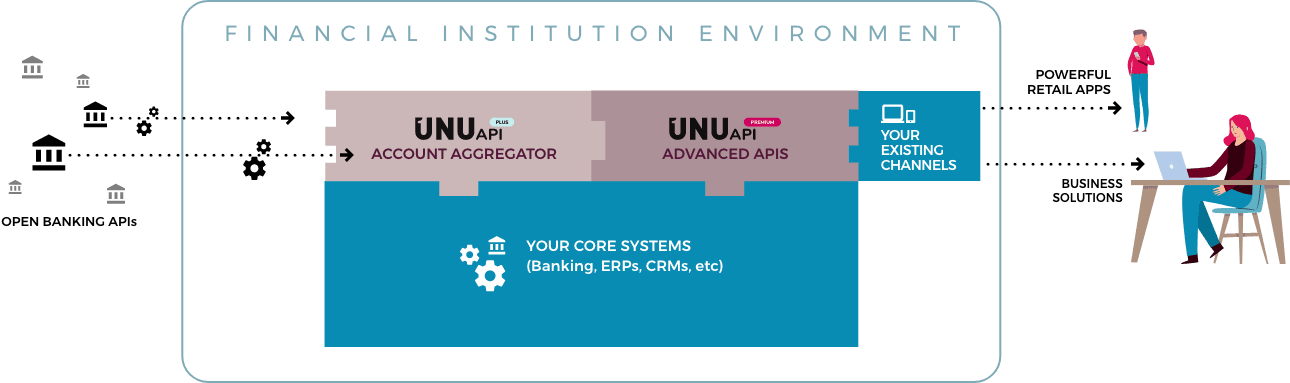

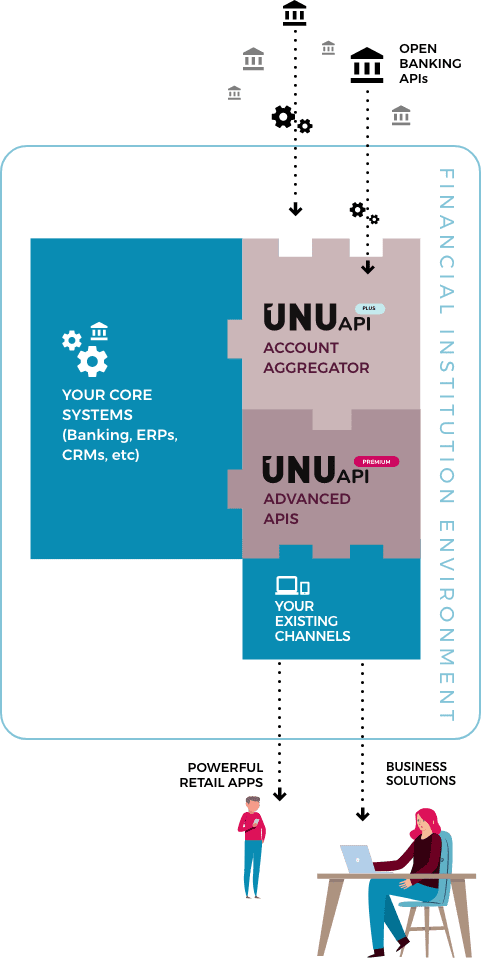

Provides the necessary ingredients to harvest the open banking APIs out there. Connect to multiple banks with the effort of one and allow users to access all their financial data.

Uniform connectivity

Multibanking on request

AISP and PISP features

In the safety of your Cloud environment

Developer-friendly

Who needs it

Banks can improve their web and mobile apps with account aggregation from other banks. Neobanks and Fintechs can compete with traditional financial institutions by offering aggregation and payment initiation services through their platforms. ERPs and software providers can enhance their products, offering multibanking to corporates with no need of a TPP license.

Do you want to talk details and hear about our flat rate pricing?

Let’s schedule a short conference call to hear about your project

Contact usHow the magic works

Who needs it

Financial Institutions, FinTechs, and Challenger banks can offer advanced Business Financial Management (BFM) products to their clients. Corporates can achieve great efficiency and control over their banking relationships without the need for a TPP license. Financial technology innovators can become digital champions with advanced APIs and attract new users.

Do you want to explore our premium APIs?

Let’s schedule a short conference call to hear about your project

Contact us

A free step-by-step analysis on how to add accounts aggregation to your application

Download for free