Join us in Canary Wharf this December at L39.

Follow our PSD2 for Experts series and learn all there is to know about TPP, AISP, PISP and how to execute payments under PSD2.

RBS’s Open Banking Strategy and further thoughts on APIs, Fintechs, Disruption and being an incumbent in a post-PSD2 Financial Services Landscape

PSD2 is rapidly becoming a “household name”, across the Banking industry in the EU, fueled by the ticking clock of looming compliance & regulation, as well as the promise of Open Banking opportunities…

With the emergence of non-traditional financial services providers and the PSD2 regulation in Europe, it seems that the entire industry is talking about open banking.

What are the 5 key points for banks to watch out for when developing and implementing an APIs / Open Banking strategy? Read more

Will you use an off-the-shelf platform for your most important banking channel? Or choose to work with a bona fide FinTech expert, for a tailor-made solution?

The WHAT, WHO, WHY, HOW of the PSD2 aplonAPI solution. The product presentation for our PSD2 compliant solution, that leverages API banking.

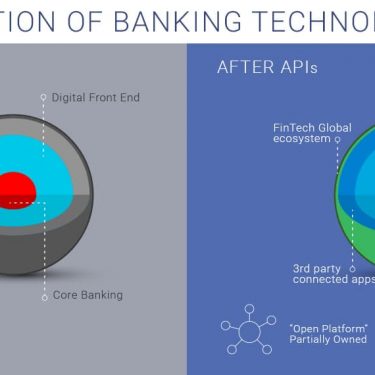

New technologies have significantly impacted the way financial institutions offer their end product to consumers. What is the change in Banking Technology Stack after APIs?